Wisconsin offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Energy

Energy Assistance

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Wisconsin State Capitol

2 E Main St,

Madison, WI 53702

Phone: (608) 266-0382

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Hours: Weekends & Holidays 8:00am-4:00pm

We Energies

231 W Michigan St

Milwaukee, WI 53203-2918

Phone: (800) 242-9137 (Residential)

Phone: (800) 714-7777 (Business)

Hours: M-F 8:00am-5:00pm

Energy Division

Wisconsin Office of Energy Innovation

4822 Madison Yards Way, 6th Floor

Madison, WI 53705

Phone: (608) 513-9408

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Milwaukee/Sullivan Weather Bureau

N3533 Hardscrabble Road

Dousman, WI 53118

Phone: (262) 965-2074

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Exemption | 100% of the added value | The purchase and installation of solar panels |

| Sales Tax Exemption | Approx. $910 | The purchase and installation of solar panels |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Wisconsin Solar Energy Background

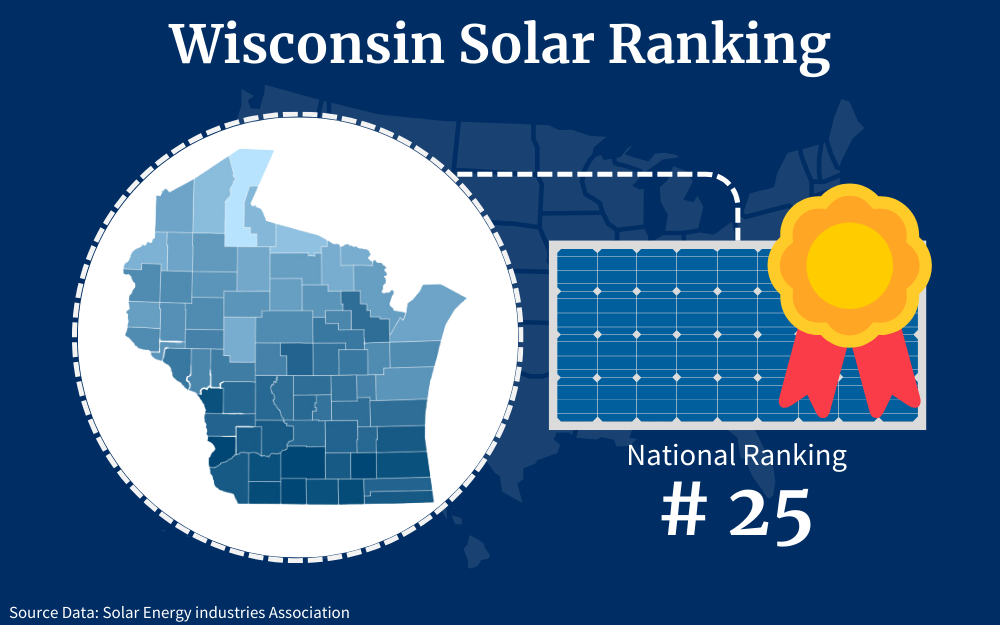

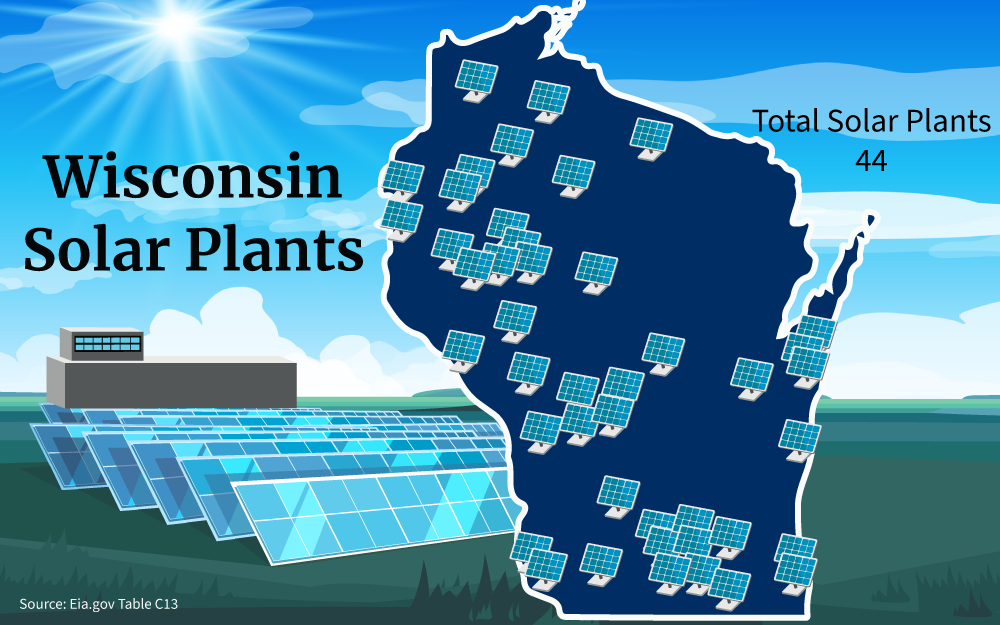

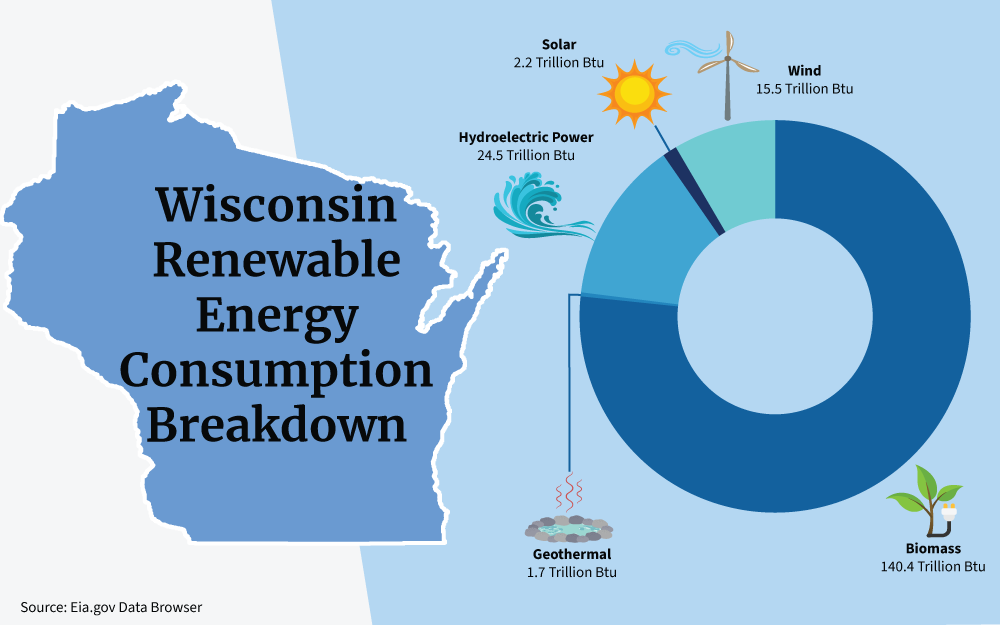

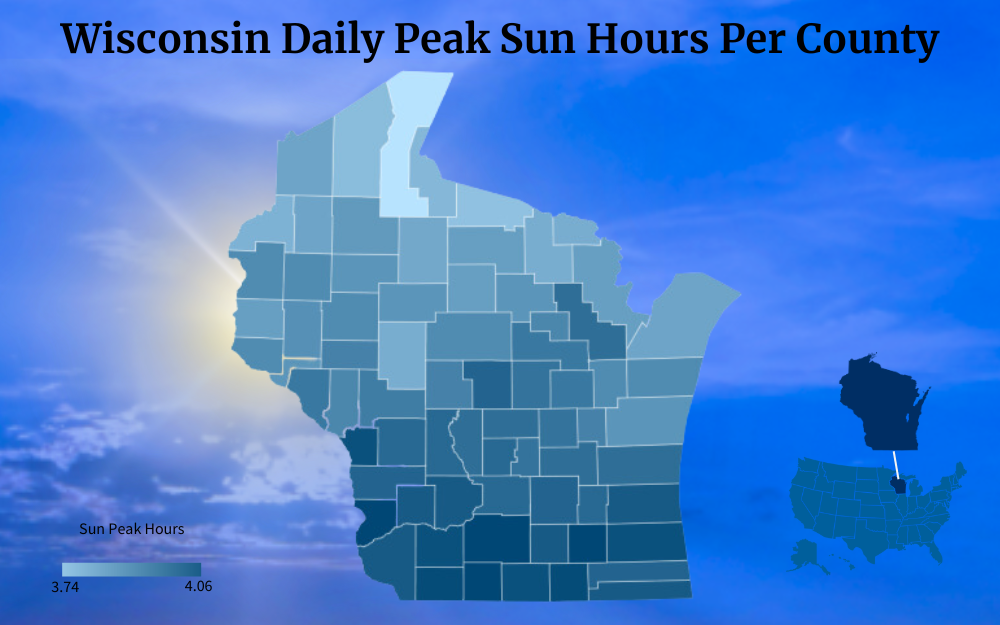

Generally, solar power isn’t the first thing that comes to mind when talking about Wisconsin, but with Wisconsin solar incentives making green energy system costs cheaper than ever, that may change.

There is significant potential for the solar energy market in Wisconsin.

Much of the power in the state comes from fossil fuel sources including natural gas and oil, but the positive impact of solar energy on environment is bringing residential and commercial property owners and investors around, and the state currently ranks 25th in the nation for solar adoption.

If you are looking for a way to beat high electricity costs or would like to have a reliable energy source that frees you from the grid, this guide explains the available Wisconsin solar incentives that can help you, as well as renewable energy rebates and programs that can reduce your costs even more.

At the state level, the Wisconsin Department of Agriculture already has materials designed to help residential and commercial property owners understand the options and incentives available to them.1

Understanding Wisconsin Solar Incentives and Options

A solar tax credit is not a check that the federal or state government sends you. Instead, it allows you to reduce your tax liability. At this writing, you can save as much as $7,500 off your federal tax liability, and the exact amount depends on several factors, such as the year in which the solar energy system was installed.

In order to claim the federal solar tax credit, you need to complete IRS Form 5695,9 which deals with home energy projects. You also need to provide detailed invoices that include the cost of your solar energy installation. The equipment manufacturer also needs to provide you with a certification that the products you purchase fall under the guidelines of the credit.

At the state level, Wisconsin offers a number of incentives, which we will explore further in the next section. These take the form of exemptions from sales and property taxes as well as a modest solar panel rebate (Wisconsin).

Federal and Wisconsin State Solar Incentives

When you have solar panels installed, you may qualify for significant tax breaks at the federal and state level. For example, the U.S. government has a solar tax credit program that can apply as much as 30 percent of installation cost against your income tax liability.

The federal credit is an ITC (investment tax credit). The purpose of this is to boost investment in an area that the government would like to support.

President Joe Biden signed the Inflation Reduction Act into law in 2022, and one provision of this legislation ensured that solar tax credits would be available through 2034.

The Federal Tax Credit

Residents who plan to install rooftop solar panels for homes will have questions like, “What if I don’t own the house, can I take the tax credit?” or “If a roof replacement is required, is that covered by the tax credit?”

So, what does the tax credit cover exactly? Some example projects include:

- Solar panel installations

- Solar-powered water heaters

- Biomass systems for fuel

- Small wind power

- Geothermal pumps for heating

- Fuel cell initiatives

If you want to receive the federal tax credit, there are some basic requirements:

- The project must be inside your U.S.-based dwelling. According to the IRS, this can be anywhere you lived during the tax year for which you want the credit.2

This could be a “house, houseboat, mobile home, cooperative apartment, condominium, or a manufactured home.” - You have to be the owner of the system. It is possible to lease solar electric systems (or other systems that are also eligible for the credit), but unless you purchased the system, you do not get the credit.

- The projects must have come into service in 2017 or later. If you had a project installed before this program came into being, you cannot use it to reduce your tax liability.

It is important to note that you cannot get more of a credit than your tax liability. If you only owe $1,200 in federal income taxes, it does not matter how much you spent on your solar panel installation — you still only get $1,200 in tax credit because you are capped at your liability when it comes to the credit.

Wisconsin’s Solar Sales Tax Exemption

In the State of Wisconsin, the government levies a 5 percent sales tax on all purchases.3 However, the state looks to incentivize the installation of solar power panels by exempting qualifying solar equipment from this levy.

As of this writing, the average installation of a solar project in Wisconsin costs $18,200; the solar sales tax exemption would save a homeowner $910 on average. Because this is not a rebate, your solar installer will include these savings.

Because these savings are applied automatically to all purchases of solar equipment in the state, you do not have to do anything to receive this benefit.

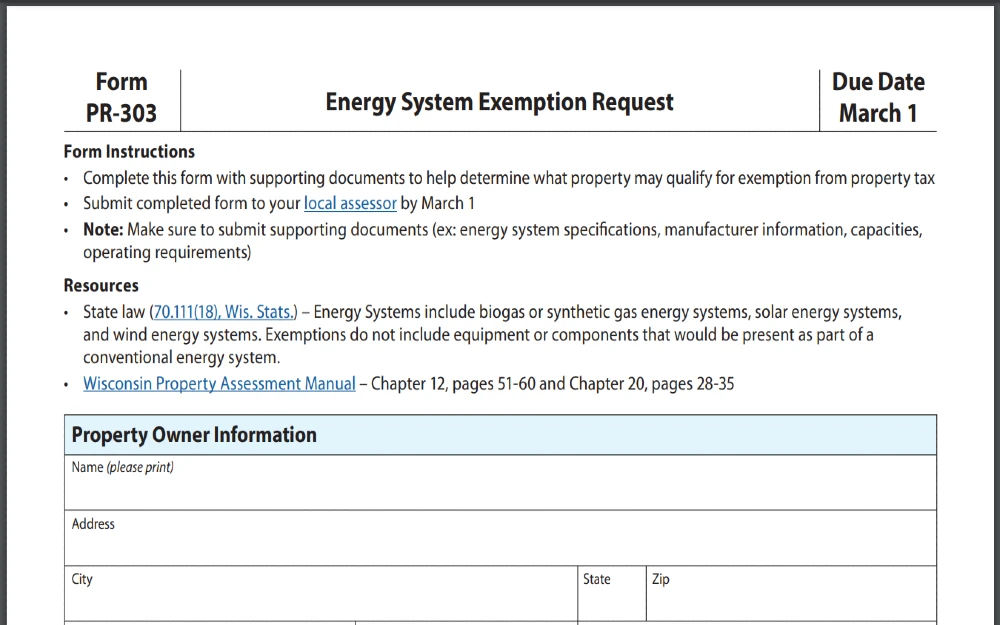

Wisconsin’s Solar Property Tax Exemption

Improvements to your residential property almost always lead to an increase in the value of that property. Installing solar panels has led to increases in property value in just about every real estate market.

While an increase in home value is great when you are ready to sell, property tax levies are based on the appraised value of the home so if you do not plan to sell,14 you end up paying higher taxes after having solar panels installed.

In Wisconsin, though, you do not have to pay property taxes on the increase in your residence’s value that you realize from solar energy system installation. According to Zillow, solar panels add about 4.1 percent to the value of a home.

At the end of 2022, Wisconsin home values averaged approximately $270,017 in value — which means that solar panels added an average of $11,070 to their value. Different parts of Wisconsin will have different property values, though, so you will want to consult with a local realtor and your local tax assessor-collector’s office to determine the increase in your property taxes due to solar installation so that you will know the amount of your exemption.

Focus on Energy Program

The Focus on Energy program is one of several cash rebate programs operated at the state and/or city level in Wisconsin.4 For qualified solar installation, Wisconsin homeowners can receive rebates as high as $500.

Residential property owners who live in rural areas can qualify for $500 more for each solar project. If the solar installation is a part of new residential construction for owner-occupied housing deemed affordable, the program offers incentives as high as $17,500, or $2,500 per KW.

Greenpenny

This program is available to homeowners in Wisconsin as well as Minnesota, Iowa, and Illinois. Greenpenny provides loans that are more accessible than financing through traditional lenders as their mission is to provide financing for renewable energy projects.10

In many cases, the interest rates are quite low so that residential property owners can minimize the total cost of their installation.

Clean Energy Credit Union

Clean Energy Credit Union (CECU) operates similarly to Greenpenny, providing a variety of financing options for solar installation projects.11

Wisconsin residents can receive loans as high as $90,000 for the installation of solar panels as well as other equipment designed to produce clean energy. The interest rates are often below the market average and are often easier to access than loans through traditional lending institutions.

Milwaukee Shines

For residents of the city of Milwaukee, this program provides loans as high as $20,000 at low APRs for new solar energy installations.12

Does Wisconsin Offer Net Metering and Power Purchasing Agreements (PPA)?

Net metering is a practice that energy providers often include as part of their service rather than one of the federal or Wisconsin solar incentives.

When homeowners produce more energy than they use with their solar panel installations, that excess amount appears as a credit on their next monthly statement. This is just another incentive designed to ease the financial burden involved with installing solar and other renewable energy systems.

Power purchasing agreements, or PPAs, are financial agreements in which a developer owns and operates a solar panel system.8 You, as the customer, agree to house the system on your property and buy its output for a preset time period to pay off the cost of the installation.

Until December 2022, this type of agreement was kept in limbo in the state of Wisconsin as state law was not clear about whether third parties could own residential power generation equipment. No law forbade the arrangement, but no law specifically allowed it either.

It took a ruling from the Wisconsin Public Service Commission (PSC) on behalf of a family in Stevens Point, Wisconsin, to allow the arrangement.

Electric providers who had opposed this position argued that the arrangement would render the solar energy provider a utility operating illegally in the territory of another utility. However, Wisconsin energy providers have denied solar interconnection for customers, so the PSC determined that residential customers had the right to use solar power if they saw fit.

The primary benefit of this ruling is to allow families to benefit from Wisconsin solar incentives and take advantage of the reduced costs to bring renewable energy into their own homes. It should not be mistaken as a method of how can you get solar panels for free.

How To Qualify for Wisconsin Solar Rebates and Credits

At the federal level, IRS Form 5695 is the document that you must submit, along with your Form 1040 federal return and any other attachments required for other purposes, to receive your solar tax credit. Documentation to support Form 5695 includes the invoices you received from the installer as well as the certification from the equipment manufacturer that your system qualifies for the federal tax credit.

As far as Wisconsin residents are concerned, the sales tax rebate automatically applies when you purchase the equipment, or when a provider purchases the equipment as part of the installation process. For the property tax rebate, retain your invoices from the installation and submit this as part of a property tax appraisal protest when that time period arrives.

To receive the Focus on Energy rebate, eligibility varies by utility provider. The initiative has a website where you check to see if your provider is part of the program and then work to reserve your portion of available rebate funds.

After you finish installing your system, you work with your Trade Ally to get your rebate.

How Much Do Solar Panels Cost in Wisconsin?

As of September 2023, Wisconsin solar panel installation costs, on average, $3.34 per watt. So if a homeowner orders a solar panel system that provides 5 kilowatts (kW), then the average gross cost will be $16,700.5

Currently, the federal ITC is 30 percent, and if one considers the state and local Wisconsin solar incentives, the net price can fall significantly.

Over 20 years, the average savings on a solar panel installation project in Wisconsin is $17,792, and the average payback period is 12.42 years.

Both of these numbers assume that you are paying for your installation in cash or are finding another way to avoid financing. Taking out a loan will involve interest expense, which will lengthen the payback period and reduce overall savings.

You can also search for a solar energy savings calculator online to help you crunch out the numbers for you.

What Equipment Do You Need for a Solar Energy Installation?

Obviously, the solar panels you’ll have installed are the most visible equipment involved in the project. Solar panels generally leverage one of two types of technology that uses PV modules: polycrystalline and monocrystalline.

Polycrystalline panels tend to cost less money, but you pay the price with less efficiency. Monocrystalline panels offer more efficiency but also come with a higher price.

Polycrystalline panels are lighter blue than their more efficient alternatives.

So, what are solar panels for?

Through the photovoltaic cells, solar panels turn sunlight into direct current (DC) electricity for delivery to a residential power system. However, the majority of dwellings have wiring for alternating current (AC) power, so your system also needs inverters to turn the power from DC to AC.

Several types of inverters exist, including string inverters, microinverters, and power optimizers.

String inverters are the least expensive type of technology linking your solar panels to the electrical circuit box in your dwelling. They connect solar panels to your circuit box as a single unit.

However, if one panel falls under cloud cover or shade from a tree, you might wonder, do they still gather solar energy? And does it affect how long can solar panels last without sun?

The entire array of panels can still gather solar power but will suffer from reduced output until that issue is taken care of.

Additionally, solar panels can last up to 25 years even without the sun to gather solar power; something that you can attribute to wear and tear due to exposure to natural elements.

Microinverters connect individually to each solar panel, boosting production for the entire array. Because each panel has a unique microinverter, blockage or shade over one panel will not affect the whole array.

With microinverters, homeowners can track the performance of each individual panel in the array. Microinverters do come at a higher cost but also boost efficiency.

Power optimizers are essentially a combination of string inverters and microinverters. They connect to each panel, like microinverters, but they do not actually invert the power from DC to AC.

Instead, they condition the direct current power and send it to one inverter where the change to AC takes place. This is not as efficient as a microinverter system, but it also costs less.

Solar panels do not attach directly to your roof. Instead, the installers will first attach solar racking equipment to your roof.

This is basically framing that allows the installer to point the solar panels to the south, at an angle somewhere between 30 and 50 degrees. This minimizes damage to your roof and optimizes the capture of energy from the sun’s rays.

The equipment also exists for solar carports and ground mount solar. If you are having ground mount solar installed, you have the option of track and fixed mounts.

Track mounts shift the solar panels during the day to keep them optimally angled toward the sun, while fixed mounts always stay at the same orientation and angle.

If you take advantage of Wisconsin solar incentives, you are likely looking forward to seeing your electric bills decrease over time — or even drop to zero. Because of this, you will benefit from having a performance monitoring system.

This sends the electricity production that your system generates directly to you, often to an app that you can track on your phone. This allows you to keep an eye on the system and report panel problems to your installer — and take advantage of warranties while they remain active.

Monitoring systems are either on-site (installed along with your solar panels) or remote (tracking your system through the cloud).

One final piece of equipment that many residential solar panel customers request is energy storage. Obviously, when the sun is down, your panels will not collect any electricity.

When the weather is extremely cold or when the cloud cover is heavy, your system also will not generate as much power.

As of this writing, solar-plus-storage, or solar batteries, come with either lead-acid or lithium-ion technologies. Lithium-ion offers greater capacity but also comes at a higher price.

When lead-acid batteries end up in landfills, the bad environmental impact of solar panels is produced. Learning the methods of how are solar panels disposed of properly will help curb these effects and reduce the reasons why are solar panels bad for the environment.

How To Calculate How Many Solar Panels You Need

The number of solar panels you need and the amount of savings you will generate with them varies widely on the basis of a number of factors.6 On average, a typical home requires between 17 and 21 solar panels to handle all of the electricity usage.

To calculate your own specific needs, you will need to know the wattage of the solar panels you have in mind, your yearly electricity usage, and the production ratio estimated for your solar power system. If you divide the system size by the production ratio and divide that result by the wattage of your panels, you will know how many panels you need.

Other factors in the equation include your location, the efficiency of the panels, the rated power of the panels, and your own energy usage habits.

In Wisconsin, solar incentives will not lead to a system that generates as much power as a system the same size would generate in Arizona, for example.

In Arizona, much less of the year involves cloud cover, and the temperatures never get as cold in the American Southwest as they do in the Upper Midwest. However, you can still figure out the number of panels you need using the formula that we suggested.

Annual Power Consumption

Let’s start with your yearly electricity consumption. This number is measured in kilowatt-hours (kWh) and comes from the total power used by all of your electric appliances.

The average residence in the United States uses 10,632 kWh annually.7 To figure out your own total, look at the electric bills that you paid over the last 12 months.

Solar Panel Power Rating

Also known as panel wattage, this number tells you the power output that a specific solar panel will generate under ideal circumstances. This number generally falls between 300 and 400 watts (W) per panel.

The most commonly quoted rating is 400, so this is what the following calculation will use.

Production Ratio

This number reflects the relationship of a solar panel system’s estimated output of energy (in kWh) to the size of the system (in W). A system with a size of 8 kW that generates 16 kWh of electricity annually has a 2.0 production ratio (16/8 = 2.0).

This would be an incredible production ratio, though, as the typical range for United States-based systems falls between 1.3 and 1.6. For the purposes of this calculation, a ratio of 1.5 will be used.

So How Many Panels Do You Need?

Remember, the average home uses 10,632 kWh per year.

Divide that number by 1.5, and the answer is 7,088.

Divide that number by 400 (the number of watts per panel), and you get an answer of 17.72.

Having 18 or 19 panels installed would increase your costs but would also reduce your power bills, if not eliminate them entirely most months.

Contractor Requirements for Home Solar System Installation

As with any contractor, you will want to work with people who have established a reputation for excellent work and have taken the time to earn licensure. The North American Board of Certified Energy Practitioners (NABCEP) offers certifications to installers and is currently the top standard among all energy system installers.

Also, ensure that your installer is bonded, insured, and licensed to install home solar systems for residences in your area. If your installer plans to use subcontractors, verify the credentials of those individuals as well.

Experience is also important, while solar panels involve innovative technology, you should be able to expect at least three years of experience in the business. Your installer should be willing to communicate transparently about the work that will be required as part of the process.

One more factor comes to mind for solar installations. Since the installer will be working on your roof, one early step should involve an assessment of the roof.

Check to see if the installer recommends improvements or repairs to the roof before installation. Also, clarify who is the responsible party for damage to the roof if a leak occurs.

Finally, check online reviews for the installer. Ask the installer for prior references, but do not just accept those, as the installer is not likely to share negative reviews with you.

Solar power allows you independence from the grid that is powered by fossil fuels and also lets you make a difference when it comes to climate change.

Check into a system for your home today because Wisconsin solar incentives exist for you to take advantage of the opportunity to reduce the cost of bringing renewable energy to your home.

Frequently Ask Questions About Wisconsin Solar Incentives

What Is the Current Federal IncomeTax Credit for Solar Energy Installations?

Generally, you can expect 30 percent of your costs to apply as a federal tax income credit. Remember, though, that if this amount is greater than your tax liability before the credit, you only get the amount of your liability credited so that your tax bill becomes zero.

How Much Experience Does a Solar Panel Installer?

Ask for an installer that has at least three years of experience — and NABCEP certification. Make sure that any subcontractors have similar experience and certifications.

How Much Electricity Comes From Solar Energy in Wisconsin?

In 2021, about 10 percent of Wisconsin’s electricity came from solar. That number jumped to 16 percent in 2022.

References

1Department of Agriculture, Trade and Consumer Protection. (2023). DATCP Home Solar Power Buying Tips. Department of Agriculture, Trade and Consumer Protection. Retrieved September 16, 2023, from <https://datcp.wi.gov/Pages/Programs_Services/SolarPowerBuyingTips.aspx>

2Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. IRS. Retrieved September 16, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

3Wisconsin Department of Revenue. (2023). DOR Tax Rates. Wisconsin Department of Revenue. Retrieved September 16, 2023, from <https://www.revenue.wi.gov/Pages/FAQS/pcs-taxrates.aspx>

4U.S. Department of Energy. (2023). Focus on Energy. Better Buildings Initiative. Retrieved September 16, 2023, from <https://betterbuildingssolutioncenter.energy.gov/partners/focus-energy>

5Berkeley Lab. (2023). Tracking the Sun. Electricity Markets. Retrieved September 16, 2023, from <https://emp.lbl.gov/tracking-the-sun>

6United States Environmental Protection Agency. (2023, March 30). Local Renewable Energy: Solar. EPA. Retrieved September 16, 2023, from <https://www.epa.gov/statelocalenergy/local-renewable-energy-solar>

7U.S. Energy Information Administration. (2023, September 13). Frequently Asked Questions (FAQs). Retrieved September 16, 2023, from <https://www.eia.gov/tools/faqs/faq.php?id=97&t=3>

8United States Environmental Protection Agency. (2023, June 14). Financing. EPA. Retrieved September 16, 2023, from <https://www.epa.gov/green-power-markets/financing>

9Internal Revenue Service. (2023). Residential Energy Credits. IRS. Retrieved September 16, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

10Greenpenny. (2023). Residential Solar Financing. Greenpenny. Retrieved September 18, 2023, from <https://www.greenpenny.bank/Personal-Services/Solar-Lending>

11Clean Energy Federal Credit Union. (2023). Clean Energy Federal Credit Union Homepage. Clean Energy Federal Credit Union. Retrieved September 18, 2023, from <https://www.cleanenergycu.org/>

12City of Milwaukee. (2023). Welcome to the Milwaukee Shines Solar Program. City of Milwaukee. Retrieved September 19, 2023, from <https://city.milwaukee.gov/eco/Buildings-Energy/Residential-Solar-Energy>

13Photo by Lacrossewi. Wikimedia Commons. Retrieved September 16, 2023, from <https://commons.wikimedia.org/wiki/File:WI_Gov_Mansion_Solar_Panel.JPG>

14State of Wisconsin. (2023). Form PR-303. State of Wisconsin. Retrieved September 16, 2023, from <https://www.revenue.wi.gov/DORForms/pr-303.pdf>